07/27/2010 New FHWA-1391 & 1392 Annual EEO Forms for Highway Contractors

7/27/2010 New Federal Highway Administration 1391 & 1392 Forms for Highway Contractors. Requires Reporting of Employees Who Are of Two or More Races.

New FHWA-1391 & FHWA-1392 Federal-Aid Highway Construction Contractor’s Annual EEO Reports were released by the Federal Highway Administration (FHWA) in June 2010.

For additional information about the release of this form (as well as some potential problems that you could experience), read our blog post about the new 1391 & 1392 Forms. The new FHWA-1391 & 1392 forms are printed on legal sized paper and require that you report how many employees (by gender and work classification) belong to more than one race and the race classifications have changed slightly.

pdf

See a sample of the NEW 1391 form here

.

The new FHWA-1391 & 1392 forms are printed on legal sized paper and require that you report how many employees (by gender and work classification) belong to more than one race and the race classifications have changed slightly.

pdf

See a sample of the NEW 1391 form here

.

------------------------------------------------------

You may obtain this update by following the instructions below - this is a program update ONLY and MUST be installed on each computer that CPS is installed on:

- Close QuickBooks.

- Start Certified Payroll Solultion (CPS) - BACKUP YOUR CPS DATA! Backup & Restore menu -> Enhanced Backup -> if necessary click the big ? (question mark) in the lower right corner for complete instruction for setting CPS up to perform automatic backups each time you exit the program.

- From the CPS Help menu -> choose Check for Updates -> From the Select an Update drop down menu, choose *Version 5.0.440* OR HIGHER (version numbers increase as new features functionality are included in the program).

- Click the Download & Install button twice. (CPS may seem unresponsive while it downloads & installs this update, please be patient). The program will close when the update has completed.

Certified Payroll Solution Required Setup:

Some additional setup is required in order for CPS to deliver all of the information required on the newly revised 1391 & 1392.

Use ONLY the most appropriate Job Category/Work Classifications listed in Table A to report employees:

Table A contains the following list of 15 "parent" Job Categories/Work Classifications - these classifications can often be different than the specific Job Category/Work Classification that is printed on a certified payroll report:

- Officials

- Supervisors

- Foremen/Women

- Clerical

- Equipment Operators

- Mechanics

- Truck Drivers

- Ironworkers

- Carpenters

- Cement Masons

- Electricians

- Pipefitter/Plumbers

- Painters

- Laborers-Semi Skilled

- Laborers-Unskilled

For example, list flaggers as Laborers-Unskilled, operators of paint striping trucks are NOT painters, they are truck drivers or equipment operators, form builders and helpers are carpenters, form setters are Laborers-Semi Skilled, list survey crews as Laborers-Semi Skilled for lack of a better category. Do not alter any part of the report, cross out any pre-printed categories, write in different categories, or provide information not requested on the report. This is according to instructions that we found for completing this form.

In Certified Payroll Solution, from the Basic Info menu -> choose Work Classifications -> Edit EACH of the 15 Work Classifications shown above and make sure that the "Use This Name on EEOC Reports" option is checked, see screenshot below.

Reporting Employees Who Are of Two (2) or More Races

When an employee is of mixed-race (Black & Hispanic, but predominately Black) you need to report this employee on the new 1391 & 1392 Forms in the "Two or More Races" column.

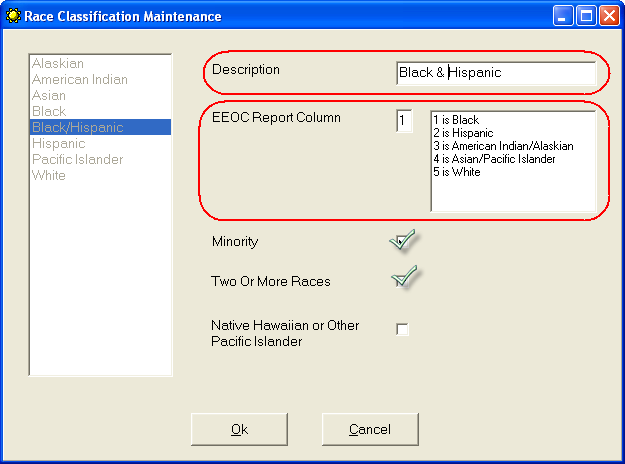

To create mixed race classifications:

Using the example above - an employee who is Black & Hispanic, but predominately Black - we will create a mixed race classification.

From the Certified Payroll Solution Basic Info menu -> choose Race Classifications -> click the ADD button -> in the Decription field, type in Black & Hispanic -> in the EEOC Report Column type in 1 for Black -> check BOTH the Minority and Two or More Races options -> click the OK button -> the Done button -> and when prompted to Save Changes, select Yes.

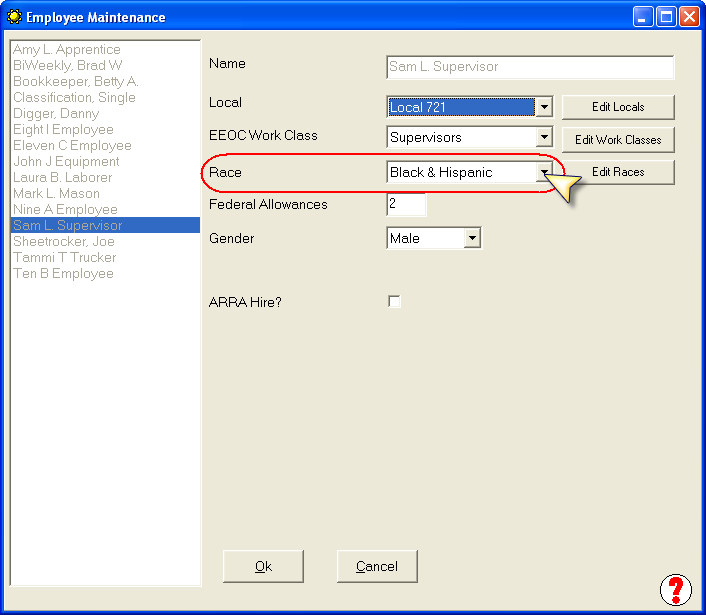

Assigning Employeess to this new race:

From the Linked Data menu -> choose Employees -> select an Employee who is both Black & Hispanic, but predominately Black -> Edit -> click the Race drop down menu -> choose the Black & Hispanic race created above -> click the OK button -> the Done button -> and when prompted to Save Changes, select Yes.

IMPORTANT NOTE:

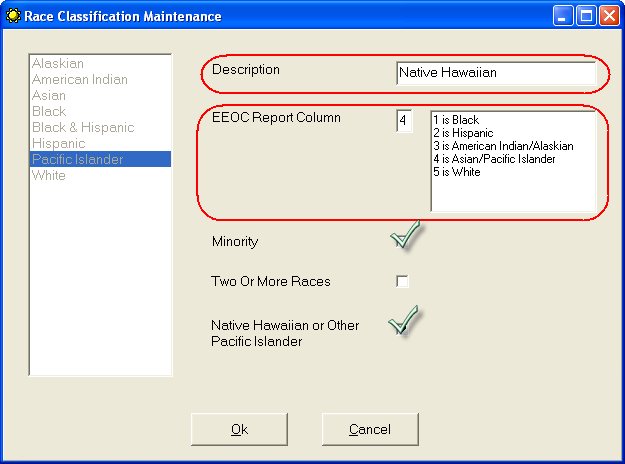

Native Hawaiian or Other Pacific Islander is a new race classification on the revised 1391 & 1392 forms, so you will need to create a NEW race (following the instructions/example above) to properly report this information. The completed Hawaiian race should be completed as shown in the screenshot below:

-------------------------------------------------------------------------------

Running the Revised 1391 Form:

From the CPS Run menu -> choose EEOC Reports -> Federal Reports -> 1391/1392 EEOC with Mixed Race -> enter the beginning and ending date for the report -> click OK -> click the Next button when it is active -> enter the Percent Complete for each job -> load your printer with LEGAL SIZED paper, select/set the number of copies you needd to print AND whether or not you want the 1392 (summary of all jobs submitted) or the 1392A Reverse -> click Print.

Warning:

During our research, we found that there seemed like there was a LOT of confusion as to the due dates and reporting dates for the 1391 (see our blog for additional details) - even confusion over the submission of the OLD or the new form. Make sure that YOU know which form you need to submit, call the main DOT office, the General Contractor, Project Owner, Contract Administrator, etc., if necessary.

Special Announcements:

- QuickBooks Desktop 2021 software will be discontinued

- Why We Aren't Compatible With QuickBooks Online

- Can I run your software on Right Networks?

- Compatibility for AASHTO Certified Payroll Upload for Connecticut DOT Released.

- Alaska Department of Labor-LLS Online Certified Payroll Update

- Nevada DOT AASHTO Certified Payroll Upload Available

- QuickBooks 2024 Compatibility Announced

- Resolution for problems with initial QuickBooks 2022 release

- IMPORTANT! Problems with QuickBooks 2022 - Don't Upgrade

- Important News About QuickBooks Desktop 2021 & 2022